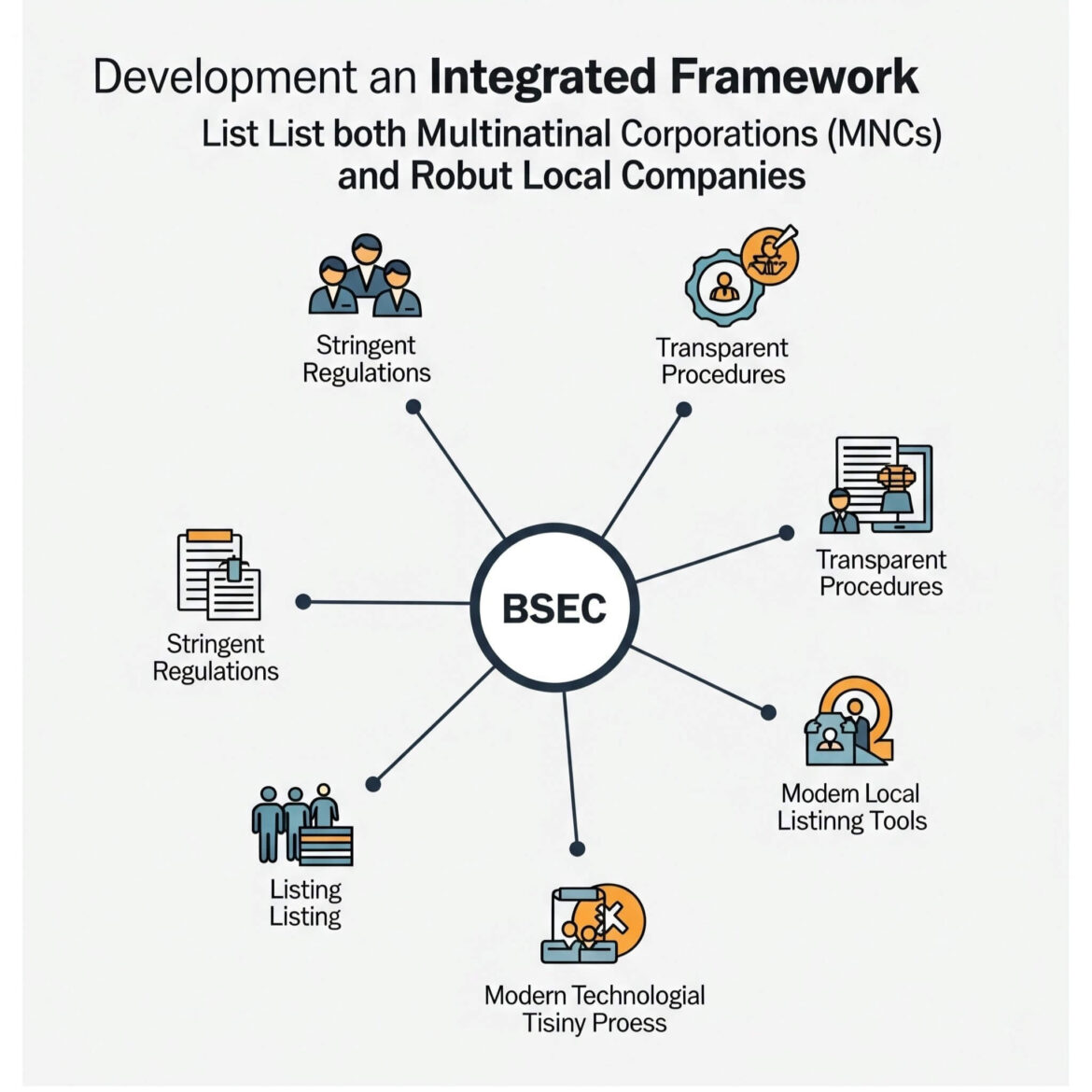

In a significant move to strengthen Bangladesh’s capital market, the Bangladesh Securities and Exchange Commission (BSEC) is actively developing an integrated framework aimed at attracting both multinational corporations (MNCs) and strong local companies for listing on the stock exchanges. This forward-thinking initiative is poised to inject new dynamism into the market, enhancing its depth, stability, and appeal to a wider range of investors. The creation of a unified listing regulation by BSEC is driven by a clear vision: to simplify the process and make it more attractive for high-quality companies to raise capital through the stock market. Currently, varying rules can sometimes pose challenges, but this new integrated approach seeks to streamline procedures, ensuring greater efficiency and predictability for prospective issuers. This effort reflects a proactive stance by the BSEC to modernize the capital market in line with international best practices. The benefits of listing more robust local companies and MNCs are manifold. Firstly, it significantly deepens the capital market by increasing the number of available quality shares. This expansion in market size and liquidity provides investors with a broader array of investment opportunities, from established local businesses to globally recognized brands. Such diversification is crucial for a healthy and resilient market. Secondly, the presence of MNCs, known for their strong corporate governance practices and financial transparency, can significantly boost investor confidence. Their listing sets a high standard, encouraging other companies to improve their own governance and reporting, thereby enhancing the overall integrity and trustworthiness of the market. This, in turn, can attract greater foreign portfolio investment, bringing in valuable foreign currency and expertise. Furthermore, a more vibrant and accessible capital market serves as a crucial avenue for companies to raise the necessary funds for their expansion, innovation, and job creation. By facilitating easier access to capital, the BSEC’s initiative directly contributes to industrial growth and overall economic development in Bangladesh. This indicates a dedication to creating conditions that help businesses succeed and make a stronger contribution to the country’s economy. In essence, BSEC’s development of an integrated listing framework is a constructive step towards transforming Bangladesh’s capital market into a more dynamic, transparent, and globally competitive platform. It promises a brighter outlook for investors, businesses, and the entire economy, ensuring that the stock market plays an increasingly pivotal role in Bangladesh’s journey towards prosperity.

Integrated Framework to Be Developed for Listing MNCs, Robust Local

45