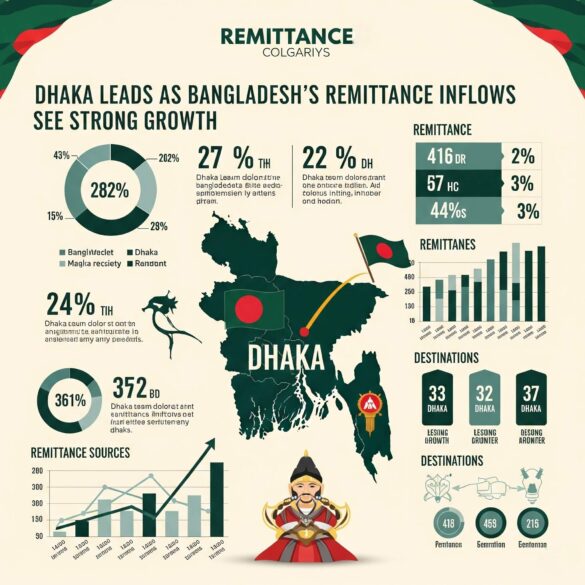

Bangladesh’s economy continues to benefit significantly from the robust flow of remittances, with the nation experiencing a substantial increase in foreign currency sent home by its expatriate workers. During the first ten months of Fiscal Year 2025 (July-April), total remittance inflows surged by an impressive 28.34 percent, reaching a remarkable $24.54 billion. This vital financial lifeline plays a crucial role in bolstering the country’s foreign reserves and supporting overall economic stability and growth. A notable aspect of this positive trend is Dhaka Division’s dominant position in receiving these funds. The capital city and its surrounding areas alone accounted for a significant 48.83 percent of the total remittances, underscoring its central role as the primary hub for economic activities and financial transactions within the country. This concentration highlights the robust banking and financial infrastructure available in Dhaka, which facilitates the smooth and efficient transfer of funds from abroad to recipients across the division. The steady and increasing flow of money sent home by Bangladeshi expats shows the dedication and effort of countless individuals who support their families and boost the country’s economy. These funds are instrumental in boosting household incomes, improving living standards, and stimulating domestic consumption and investment. For the national economy, remittances act as a crucial buffer, strengthening foreign currency reserves and helping to manage external economic pressures. This financial support is particularly vital for maintaining a healthy balance of payments and ensuring macroeconomic resilience. The government and financial institutions continue to work towards enhancing the ease and security of remittance channels, encouraging formal pathways for transfers. Initiatives promoting digital banking and mobile financial services have made it more convenient for expatriates to send money home, ensuring that these valuable contributions reach their intended beneficiaries efficiently. Such measures not only streamline the process but also contribute to the formalization of financial flows, benefiting the broader economy. As Bangladesh progresses on its development journey, the sustained growth in remittances, particularly channeled through key urban centers like Dhaka, remains a powerful force. It reflects the enduring connection between the nation and its global workforce, underscoring the critical role these financial inflows play in building a prosperous and stable future for Bangladesh.

Dhaka Leads as Bangladesh’s Remittance Inflows See Strong Growth

47