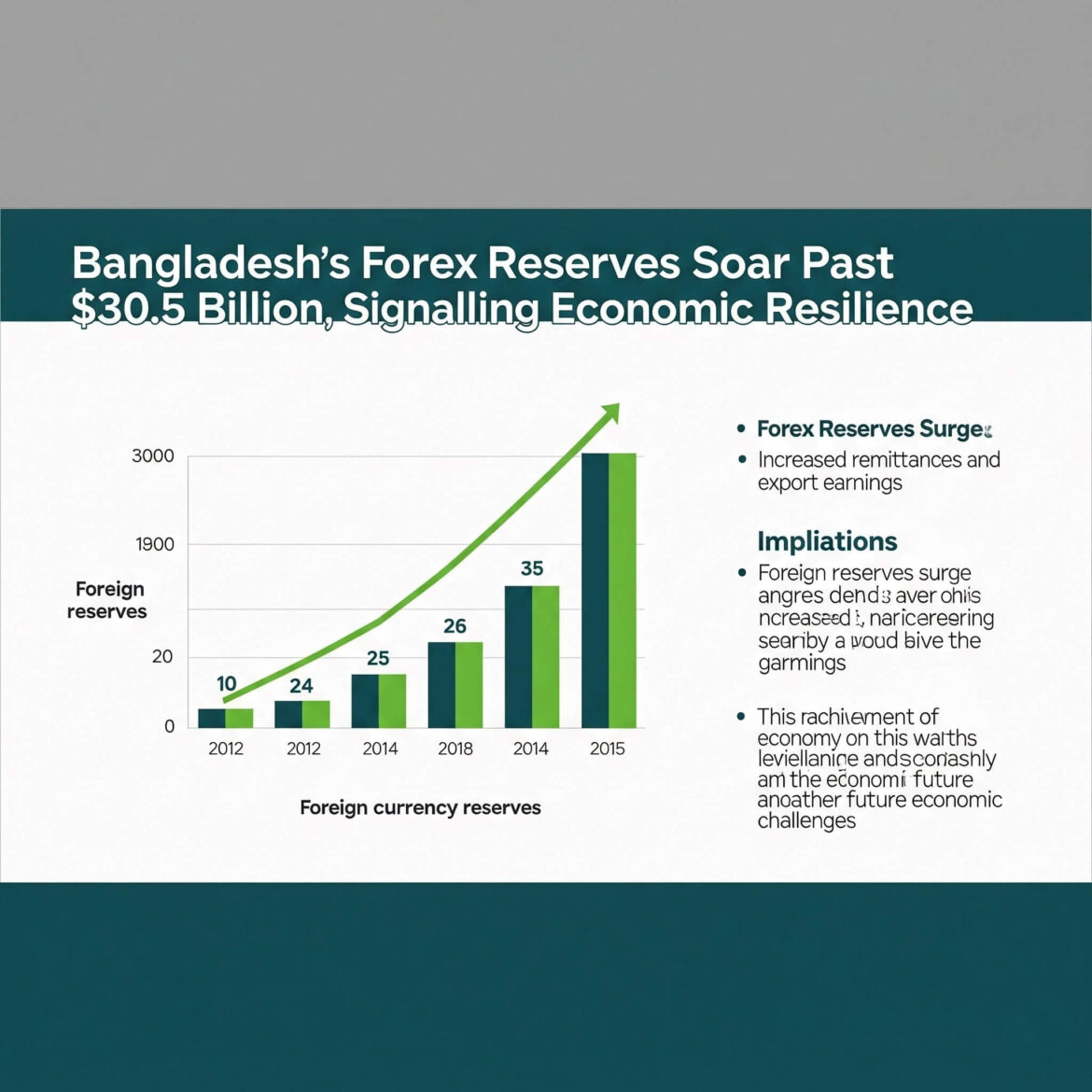

In a significant positive development for Bangladesh’s economy, the country’s foreign exchange reserves have surged past the USD 30.5 billion mark, reaching a level not seen in two years. This notable achievement, confirmed by Bangladesh Bank, signifies a robust recovery for an economy that has recently navigated global pressures. Analysts view this milestone as a clear indicator of external sector recovery, an improved current account balance, and growing investor confidence in the nation’s economic stability. The impressive growth in reserves has been primarily driven by two key factors. Firstly, a commendable increase in remittance inflows from Bangladeshi expatriates has played a crucial role. This consistent flow of foreign currency from Bangladeshi citizens working abroad underscores their unwavering contribution to the national economy, acting as a vital pillar of support during challenging times and now in this phase of recovery. In addition, major payments from important global financial partners have given a considerable uplift. Support from institutions such as the International Monetary Fund (IMF), the World Bank (WB), the Asian Development Bank (ADB), and the Japan International Cooperation Agency (JICA) reflects continued confidence in Bangladesh’s economic policies and development trajectory. These funds are not just financial injections but also signals of strong international partnerships that aid Bangladesh’s journey towards sustainable growth. Bangladesh Bank reports that June alone witnessed a remarkable increase of USD 5 billion in reserves, illustrating the rapid pace of this positive turnaround. Such a rapid accumulation of reserves offers much-needed relief to the economy, strengthening its capacity to manage external shocks and sustain essential imports. Healthy foreign exchange reserves are crucial for a nation’s economic health, providing a buffer against global economic fluctuations and ensuring stability in international trade and payments. This upward trend is warmly welcomed by economic analysts and financial experts. They interpret the surge in reserves as a definitive sign of an improving external sector, indicating that Bangladesh’s economy is successfully navigating global economic headwinds. An improved current account balance, where the country earns more from its exports and remittances than it spends on imports and services, further reinforces this positive outlook. Ultimately, this enhanced financial position is expected to foster greater investor confidence, attracting more foreign direct investment and encouraging local businesses to expand, contributing to overall national prosperity.

Bangladesh’s Forex Reserves Soar Past $30.5 Billion, Signalling Economic

49

previous post